Your dealership inventory is constantly changing and evolving. Having access to a floor plan line of credit that changes and evolves with your business crucial. In order to keep pace with changes, we developed a way for dealers to request credit increases from the palm of their hand.

Your dealership inventory is constantly changing and evolving. Having access to a floor plan line of credit that changes and evolves with your business crucial. In order to keep pace with changes, we developed a way for dealers to request credit increases from the palm of their hand.

To submit a request to increase your floor plan line of credit, you need to log into our account management platform, Account Portal. Your username and password are determined during onboarding. If you’re having trouble logging into your account, contact Account Portal support.

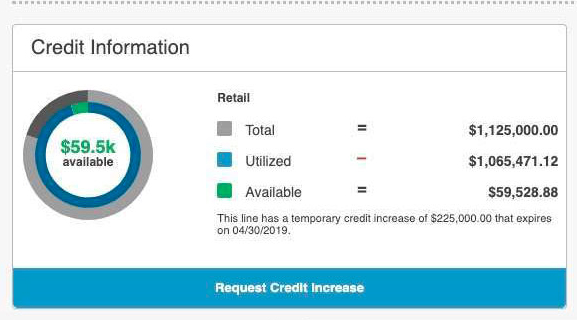

Once you’re logged into Account Portal, navigate to the “Dashboard” or homepage. On the dashboard, there should be a section labeled “Credit Information”. Inside that section, find the blue button labeled “Request Credit Increase”. Once you click the button, you will be promoted to answer a few questions.

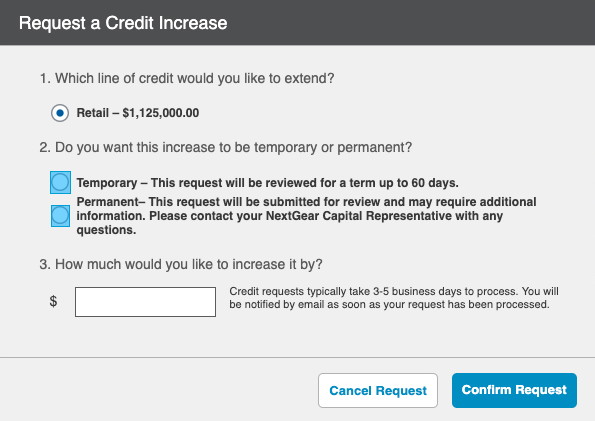

The first question is asking which floor plan you would like to extend. Select the line of credit you wish it increase.

The next question asks if you want the increase to be temporary or permanent. A temporary increase request will be reviewed for a term up to 60 days. This requires a short review to qualify for the temporary increase. A permanent increase will be submitted for review and more information may be needed. In most cases, a full Lending review is required and could result in a new term plan. It is also important to note that not all permanent requests are accepted. If you are unsure if you would like to make a temporary or permanent increase, reach out to your Performance Manager for guidance.

Once you’ve made those selections, you are asked how much you would like to increase your line of credit by. In the box provided, fill in how much additional capital you would like. Once you do that, you can confirm the request.

We work diligently to review requests, but please allow 3-5 business days for your request to process. You will be notified by email as soon as your request has been reviewed.

Exceeding Credit Limit

If you don’t submit a request for an increase and exceed your floor plan line of credit, there is still a little bit of flexibility. We highly encourage dealers to be proactive in requesting credit increases, but we understand that doesn’t always happen. NextGear Capital dealers that are close to reaching their credit limit can exceed their limit by a small margin before all flooring will be denied. Once you max out your line of credit, you will be unable to floor anything until you pay down your balance.

To recap, requesting a floor plan line of credit increase is easy! Simply:

- Log into Account Portal

- On the dashboard, find the “Credit Information” section

- Click the blue “Request Credit Increase” button

- Answer the 3 prompted questions

- Wait 3-5 business days

To get started with a NextGear Capital line of credit, contact us or apply online!