What is NextGear Capital’s Self-Audit?

NextGear Capital is revolutionizing the audit experience by introducing Self-Audit, allowing you to audit floored inventory using the NextGear Capital mobile app.

• Ease of Use: More convenient & streamlined audit processes easily completed from the convenience of the NextGear Capital mobile app.

• Self-Service: Audit your own inventory within 48 hours of the push notification and email referenced below.

• Control Costs: Take more control of fees that may be incurred in the current audit process by completing Self-Audits.

Are there fees associated with Self-Audit?

No. Self-Audit allows you to take more control of fees you might incur as part of the current audit process.

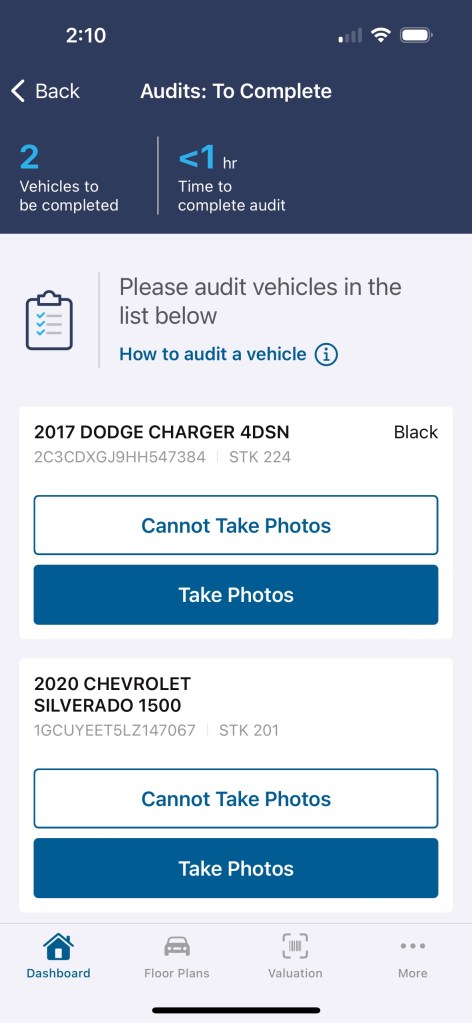

How are Self-Audits conducted?

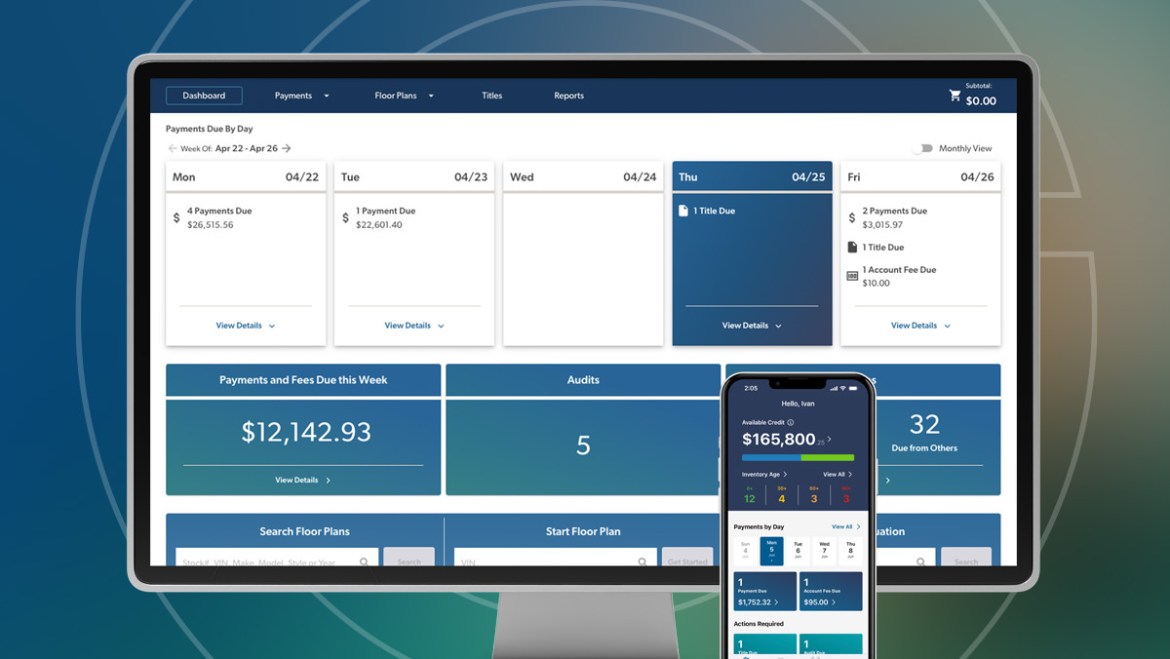

Log into the NextGear Capital mobile app, scroll to the Audits tile on your dashboard and tap the tile that shows the number of units To Complete. Select a vehicle from your inventory list to begin an audit. Simply follow the prompts to take/upload the required photos and complete the audit. Repeat the same process for any remaining vehicles on the audit. It’s that simple!

If I complete a Self-Audit, will I still have an auditor visit my lot?

A complete and successful Self-Audit will satisfy the audit requirement for that audit period. That may mean you won’t see an auditor that month. However, Self-Audit does not guarantee that you will never see an auditor in-person again.

How will I know when it’s time to self-audit?

You will receive a push notification from your NextGear Capital app and an email alerting you of an audit due on your account. You will have 48 hours from the time stamp on those alerts to complete your Self-Audit. It is your responsibility to enable push notifications from the NextGear Capital app in your device settings and check regularly for updates and notifications.

Do I have to use the NextGear Capital app?

Yes. If you do not have the app, you can download it free from the Apple App Store or Google Play. If you already have the app downloaded just ensure you are on the latest version and have enabled push notifications.

How long will I have to complete a Self-Audit?

You will have 48 hours from the time stamp on the push notification and email alerting you of an audit being due, within which to complete the Self-Audit.

Do I have to complete Self-Audits?

Yes, if you are assigned a self-audit, it is required for you to complete the audit in the 48 hour window. Any vehicles not successfully audited will be marked as unverified and require post-audit reconciliation.

Who do I contact if I need help with the Self-Audit?

You may reach out to your NextGear Capital Representative or our dedicated service team to assist with any questions regarding Self-Audit. You can reach them at ngc.customerservice@coxautoinc.com.

Can I delegate authority to complete the Self-Audit to an employee or other individual?

There is no current process to support the delegation of account management.

What if I am unavailable or out of town when the Self-Audit is assigned?

If you know you will be out of town for longer than 48 hours, you will need to contact NextGear Capital in advance. If there is an emergency that prevents you from completing the Self-Audit after it has begun, contact us to request a deferral. Failure to notify your NextGear Capital Representative or our dedicated service team may result in the loss of Self-Audit privileges.

How do I enable push notifications & location services?

iPhone Users Push Notifications

1. Go to Settings and tap Notifications.

2. From the list of apps under Notification Style, select the NextGear Capital app.

3. Turn on Allow Notifications, choose the alert style and when you want the notifications delivered.

iPhone Users Location Services Android Users Location Services

1. Go to Settings > Privacy & Security > Location Services.

2. Use the toggle next to Location Services to turn on.

Android Users Push Notifications

1. Go to Settings, tap Notifications > App Settings.

2. Tap All apps and tap the NextGear Capital app.

3. Turn on notifications, choose from the sound and notification types you prefer.

Android Users Location Services

1. Swipe down from the top of the screen twice.

2. Tap the Location icon to turn on.

*All rights reserved. Certain conditions apply. All advances are subject to the terms and conditions of your Demand Promissory Note and Loan and Security Agreement and other Loan Documents with NextGear Capital. You are responsible for ensuring you have enabled push notifications for the NextGear Capital app and to check the app regularly for any notifications. If the self-audit is not completed successfully within the designated window, additional steps will be required and fees may be incurred.NextGear Capital reserves the right to modify or terminate this offer, without notice and at any time. For complete details, terms and conditions, please see your local NextGear Capital representative. All advances made in California by NextGear Capital are made pursuant to NextGear Capital’s California Finance Lender License, #603G505.