Mikey Rudman has successfully operated Scottsdale Wholesale Direct out of Phoenix, AZ since June 2015, but realized he needed to get into another type of business while at a football game with friends. “I went to a football game in Denver with some of my colleagues and not one person was talking about the game. Instead, they were all talking about the camper vans they had just purchased.” Rudman said that while everyone loved their new camper vans, they weren’t thrilled with the hefty $100K+ price tag and 6-month build time it took before they were completed. He had already been thinking about making a change and when he realized he could take the vans he was already selling at his dealership and turn them into camper vans at a much lower price, he jumped at the opportunity. Tommy Camper Vans officially went into operation in December 2019.

Mikey Rudman has successfully operated Scottsdale Wholesale Direct out of Phoenix, AZ since June 2015, but realized he needed to get into another type of business while at a football game with friends. “I went to a football game in Denver with some of my colleagues and not one person was talking about the game. Instead, they were all talking about the camper vans they had just purchased.” Rudman said that while everyone loved their new camper vans, they weren’t thrilled with the hefty $100K+ price tag and 6-month build time it took before they were completed. He had already been thinking about making a change and when he realized he could take the vans he was already selling at his dealership and turn them into camper vans at a much lower price, he jumped at the opportunity. Tommy Camper Vans officially went into operation in December 2019.

His instincts proved to be right because a short while after opening, Rudman was approached by a customer named Rhylee for a custom build for her van. She was very specific about the things she wanted to incorporate into the build, including more storage space. Her build was completed in just 7 days and Rudman soon found out that Rhylee was a cast member from Bravo TV’s reality show Below Deck. She tagged Tommy Camper Vans on her social media accounts and in the course of a day, Scottsdale’s Instagram account views tripled. From those posts Rudman’s business received 102 inquiries about potential camper van builds including one from another Below Deck castmate, Captain Sandy Yawn. Tommy Camper Vans was also recently featured on Bravo’s “Style and Living” blog.

Circumstance was also on Rudman’s side because camper vans have significantly grown in popularity due to the current COVID-19 pandemic. “With the quarantine going on, people want to go out but don’t want to stay in a hotel or fly anywhere. They want to be safe and the best thing about the ‘van life’ is that you can still get away and keep your distance from other people. It’s not like an RV where you have to park in an dedicated space in close confinement around other RV’s. You can go off the grid, drive down to the creek or lake and just explore and unplug.”

Rudman also says that there are some key things that have helped him to be successful during the pandemic:

- The ability for his customers to easily shop online by providing multiple photos and virtual tours of his camper vans.

- Doing FaceTime walk throughs of the inventory he has available.

- Widening his customer base by providing free shipping to customers who live out of state.

- Financing assistance.

Despite his success, most of the proceeds from Tommy Camper Vans goes to nonprofit organizations. “I’ve donated to different organizations like St. Jude Children’s Research Hospital and the MS Research Foundation after I completed a build for a one of my best friends who was diagnosed with MS two years ago. I don’t care about having a lot of money so if a customer comes to me with a good cause, I’m willing to donate to that as well.”

With a 2-year-old and another baby on the way, Rudman is optimistic about the future. Since cornering the market on affordable $50,000 camper vans, Tommy Camper Vans has gone on to be the fastest growing custom van company in the world. To keep up with demand, he’s been looking into ways to increase production including the possibility of adding an assembly line to his operations at some point. He’s also working on adding Camper Van and Adventure Truck rentals to his business offerings sometime in the near future.

CARMEL, Ind. (May 1, 2020) – Cox Communications and Cox Automotive are working together to help feed families in Carmel through Gleaners Food Bank of Central Indiana with a $25,000 donation from The James M. Cox Foundation. The grant will support local families in need during the COVID-19 pandemic.

CARMEL, Ind. (May 1, 2020) – Cox Communications and Cox Automotive are working together to help feed families in Carmel through Gleaners Food Bank of Central Indiana with a $25,000 donation from The James M. Cox Foundation. The grant will support local families in need during the COVID-19 pandemic.

CARMEL, Ind. (April 24, 2020) – As part of its ongoing response to the COVID-19 pandemic,

CARMEL, Ind. (April 24, 2020) – As part of its ongoing response to the COVID-19 pandemic,

Depending

Depending

Mackie joined NextGear Capital’s executive leadership team in 2017 as vice president of sales and brings with her 25 years of leadership experience in the automotive industry. Before joining NextGear Capital, she worked for Capital One Commercial Dealer Services, Hyundai Capital America, JP Morgan Chase and Ford Motor Credit Company.

Mackie joined NextGear Capital’s executive leadership team in 2017 as vice president of sales and brings with her 25 years of leadership experience in the automotive industry. Before joining NextGear Capital, she worked for Capital One Commercial Dealer Services, Hyundai Capital America, JP Morgan Chase and Ford Motor Credit Company.

Floor plan compan

Floor plan compan

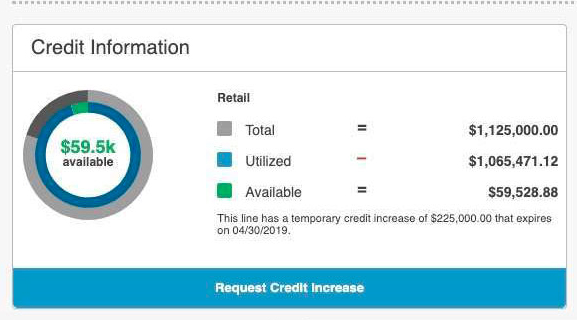

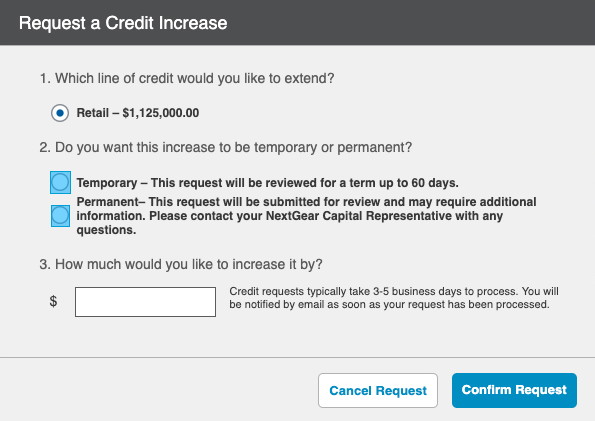

Your dealership inventory is constantly changing and evolving. Having access to a

Your dealership inventory is constantly changing and evolving. Having access to a

Whether you are just starting out or looking to grow your current business, it’s important to have the capital you need to stock your lot. Having cash tied up in inventory can put stress on the business, which is why there are many

Whether you are just starting out or looking to grow your current business, it’s important to have the capital you need to stock your lot. Having cash tied up in inventory can put stress on the business, which is why there are many

Just north of Salt Lake City sits the town of Bountiful, Utah where Imran Ahmed’s A.I. Monroe Auto Sales has been serving the local community for the past 4 years. When Ahmed opened his own dealership, he knew that incorporating a floor plan into his business model was the way to go, “I wanted to use a floor plan right away and didn’t want to spend a lot of time shopping around. I initially reached out to some local banks, but the process seemed very difficult.” Ahmed had already been purchasing most of his inventory through Manheim, so when he asked about floor planning, they directed him to NextGear Capital. “I found out that NextGear Capital’s process was much easier and as soon as I heard about the extra products they have to support my business like

Just north of Salt Lake City sits the town of Bountiful, Utah where Imran Ahmed’s A.I. Monroe Auto Sales has been serving the local community for the past 4 years. When Ahmed opened his own dealership, he knew that incorporating a floor plan into his business model was the way to go, “I wanted to use a floor plan right away and didn’t want to spend a lot of time shopping around. I initially reached out to some local banks, but the process seemed very difficult.” Ahmed had already been purchasing most of his inventory through Manheim, so when he asked about floor planning, they directed him to NextGear Capital. “I found out that NextGear Capital’s process was much easier and as soon as I heard about the extra products they have to support my business like